Beyond the numbers: 1,841 international students are shaping Lakehead’s campus culture, fostering diversity, and creating a global community.

Exam season is swiftly approaching, which means a reduction in time for anything else outside of the academic demand. With stress increasing and pressure accumulating, how should students care for themselves? Read on to find out!

Newly sworn in Prime Minister Mark Carney is currently leading in the polls over the Conservatives, and the Tories are presumably unhappy. Will Carney call a swift election to maintain his newly found momentum, and will he manage to keep Trump and the MAGA maniacs off his back? Or will he fall into the same trap as previous Canadian leadership, and be just another bad seed in an already seemingly rotten apple?

The goal of It Starts Week is to combat racism and cultural stigmatization in Simcoe County. Throughout the week, a variety of events will be held to celebrate diversity and promote inclusion. Therefore, in order to honour your heritage and that of your peers and to support the inclusive environment that Lakehead fosters, join Lakehead during the week of March 17th.

Lakehead University Student Union (LUSU) is proposing a new building at the Orillia campus to enrich student life and academic experiences. To support this initiative, a referendum is being held to seek student approval for a fee. Students are encouraged to get informed, engage in discussions with peers, and cast their vote during the polling period. Read on to find out more!

The next few days are crucial for the future of the LUSU presidency. Learn about each candidate's top priorities, how they plan to achieve them, and what sets them apart as the ideal choice for the role. Make an informed decision for the future of LUSU!

Want to get involved in International Women's Day events? From art workshops and salsa dancing to community events and fundraising initiatives. Check out these amazing on-campus and off-campus activities celebrating women’s achievements and advocating for gender equality.

As a university student, nutrition can be a component of your life that becomes trivialized due to the overwhelming amount of responsibilities that students take on. However, prioritizing healthy eating does not have to be a burden and can positively enhance your academics, mood, energy, and placate stress. Therefore, throughout the month of March, Lakehead will supply opportunities to highlight healthy and affordable eating habits, navigate sample recipes, provide free nutritional meals and affordable produce, and more. Click this article to learn the details and show your body some gratitude!

In the month of March, Lakehead is here to cater to more than just student’s academics but also other vital components of their lives. Visit this article to learn how you can diverge from the rigid academic concept of university and instead nurture your growth as a person and your well-being with versatility.

In this month’s issue

Stay connected with us.

Want to contribute?

The Argus is always looking for contributors! Dip your toes into the world of journalism and get involved with your school’s community through one of Lakehead’s longest-standing student-run programs. Shoot us an email and we will be in touch!

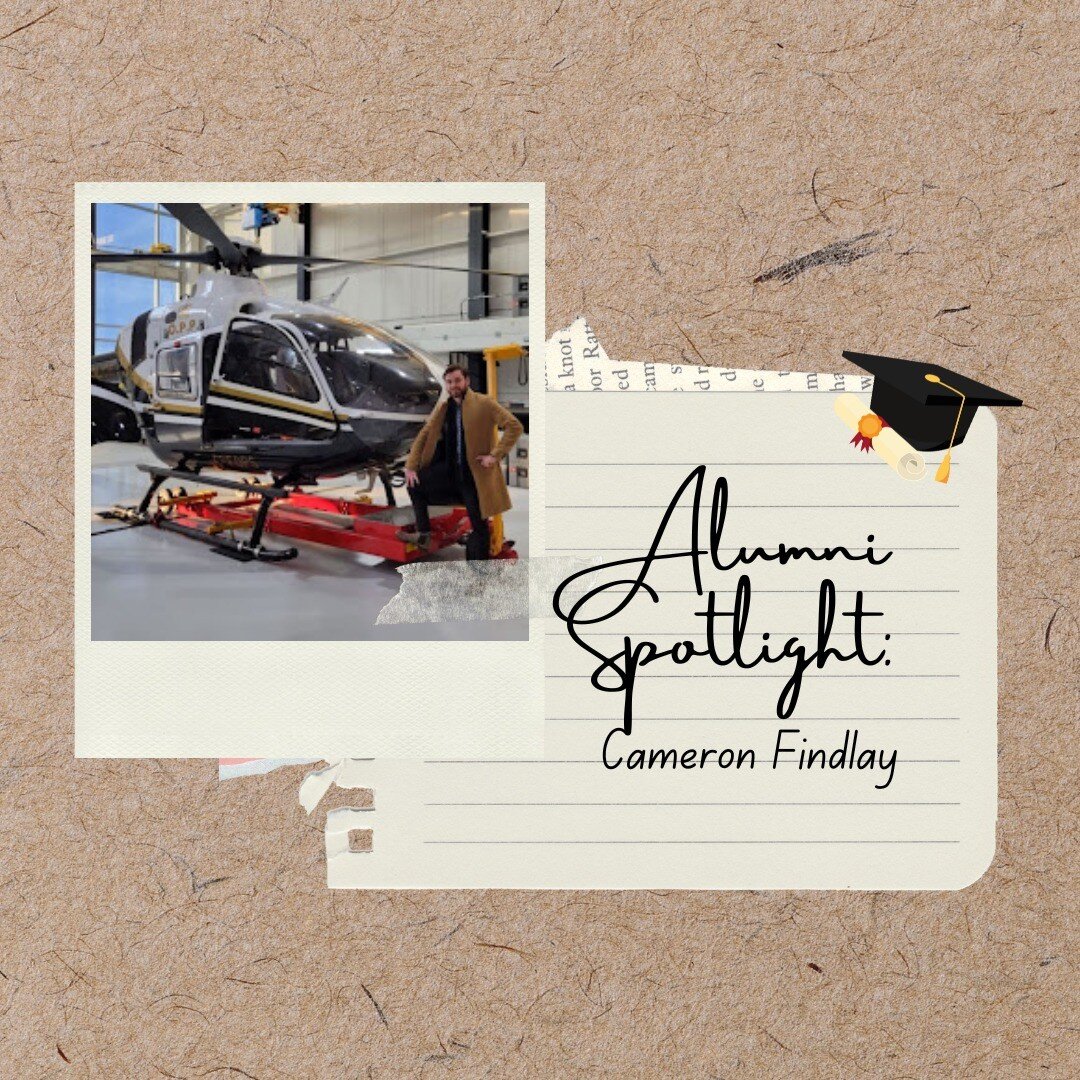

Choosing a university can be challenging; it is a pivotal decision that establishes the foundation of your career. However, it is not just academics that constitute your success but also the life you build in your university community. Therefore, with an emphasis on residence, the following informal interviews are meant to capture authentic insights as students reflect on how Lakehead has positively impacted them and why they chose to attend. If you are considering Lakehead Orillia, read on!